Real People.

Real Businesses.

Real Results.

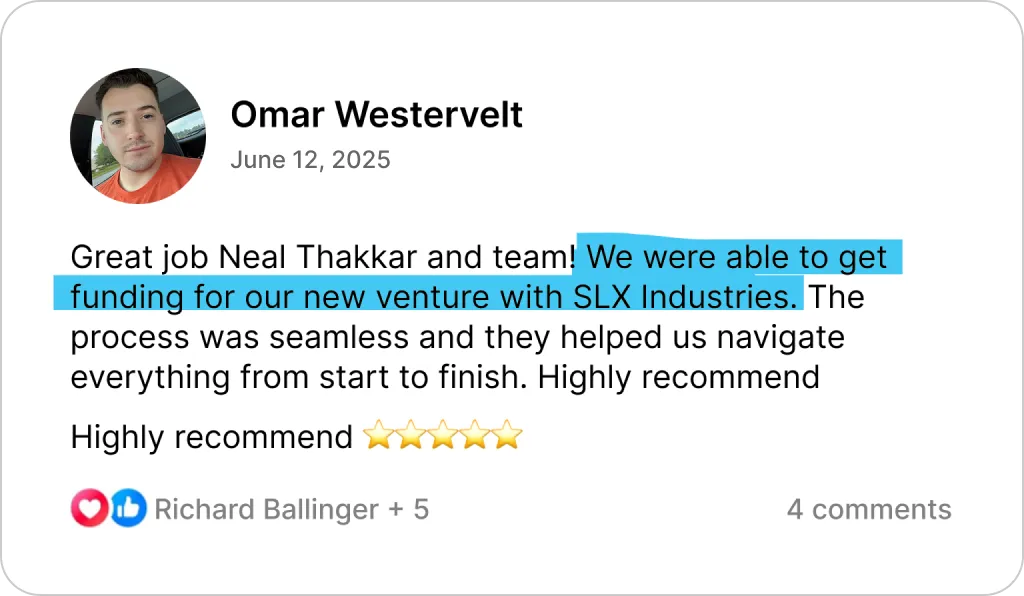

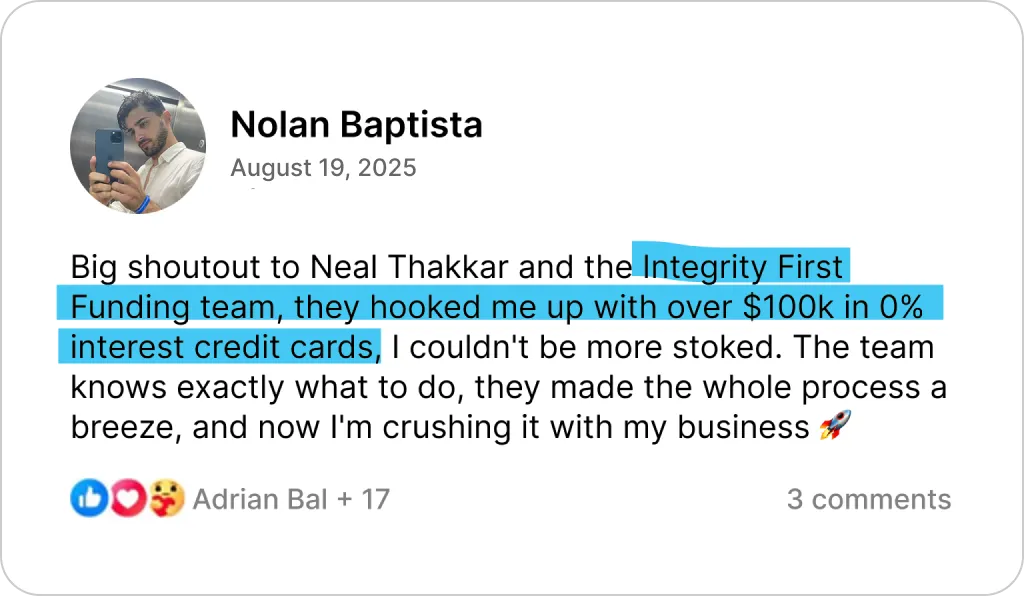

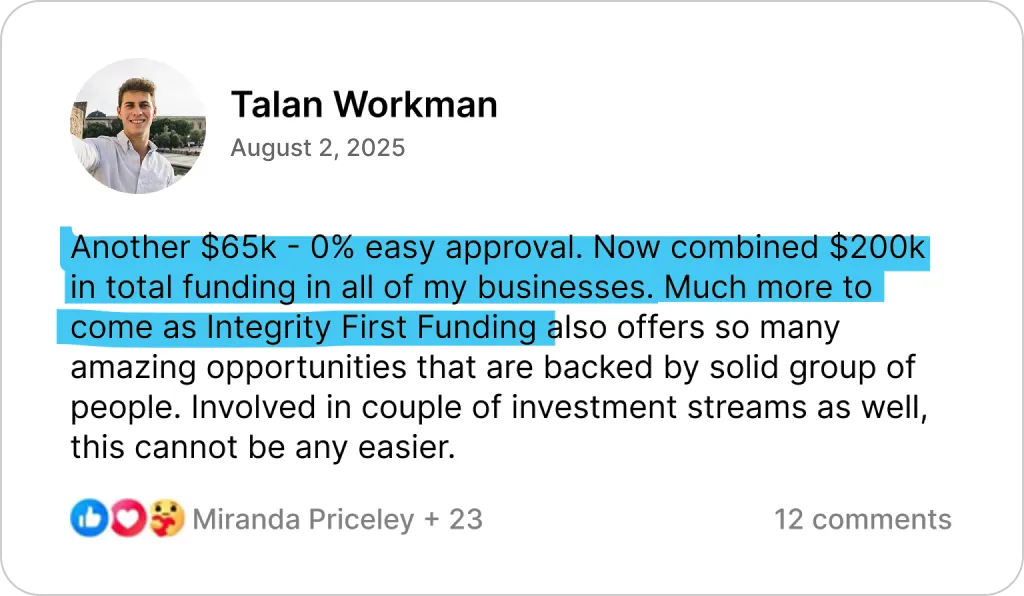

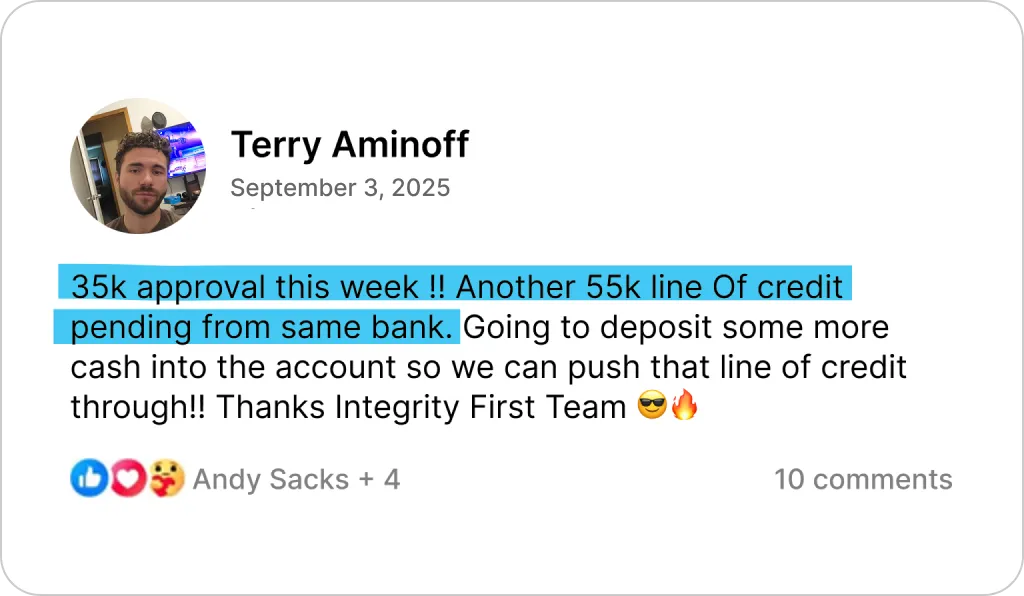

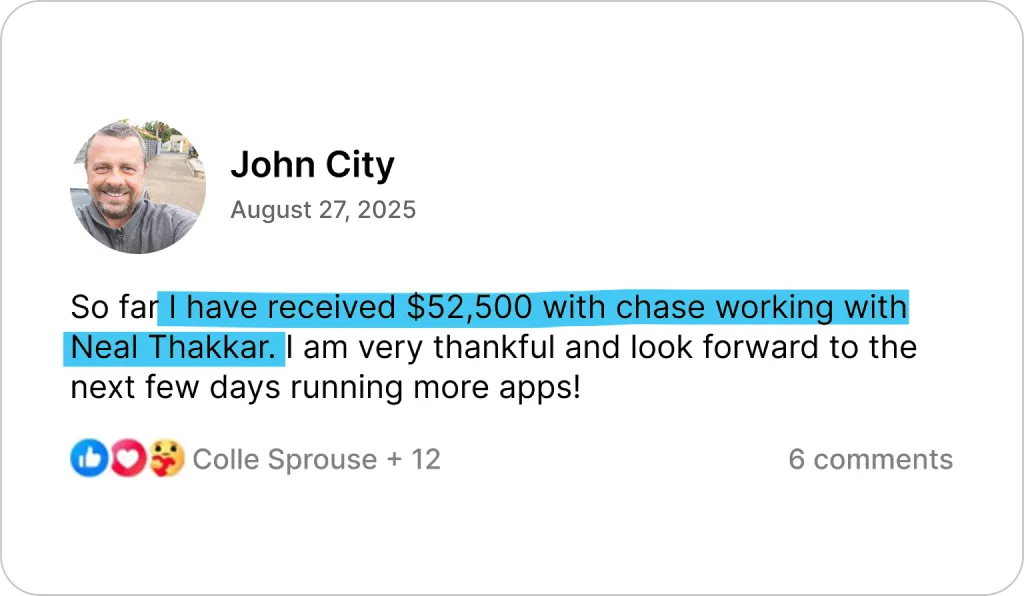

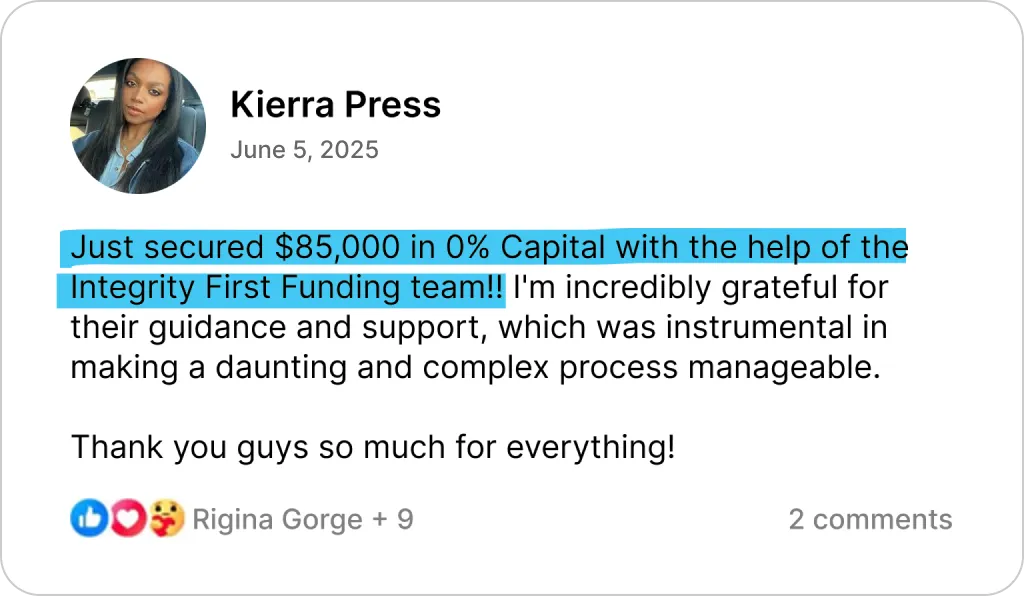

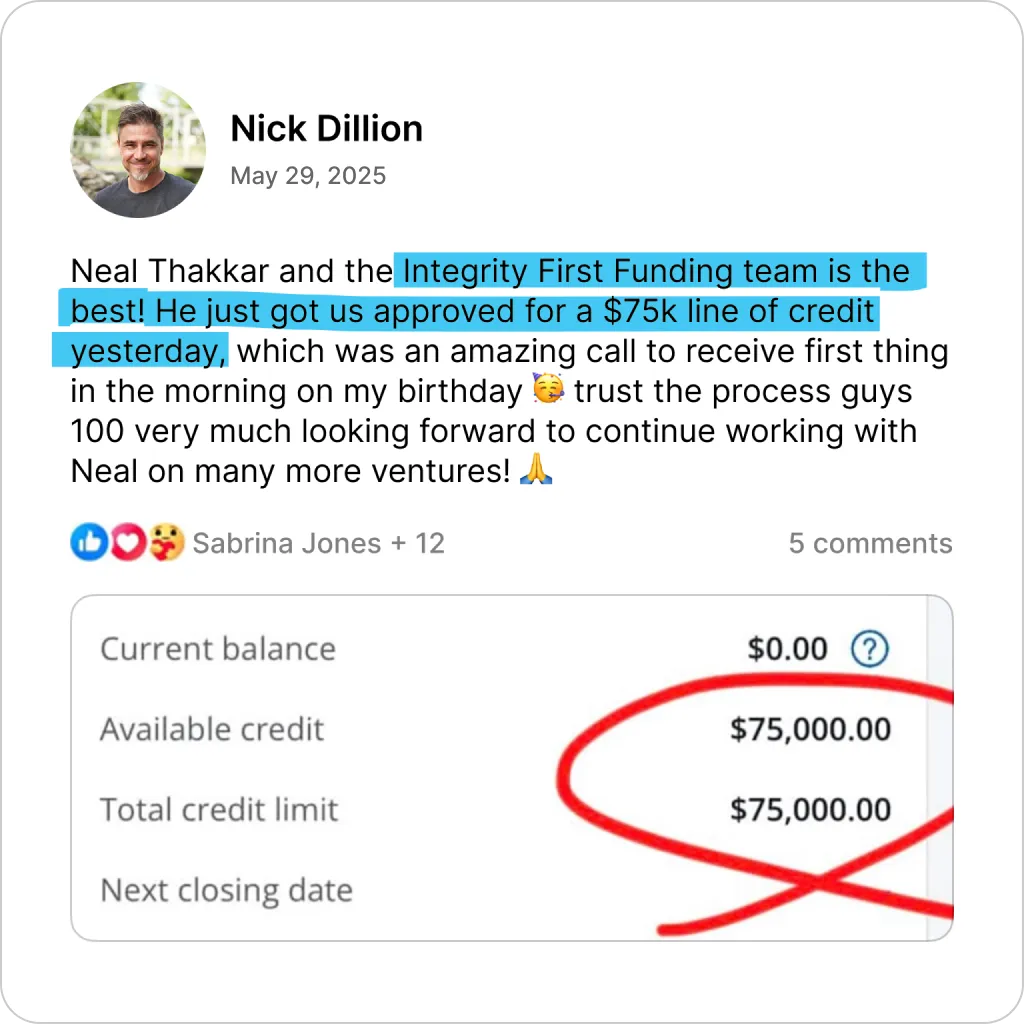

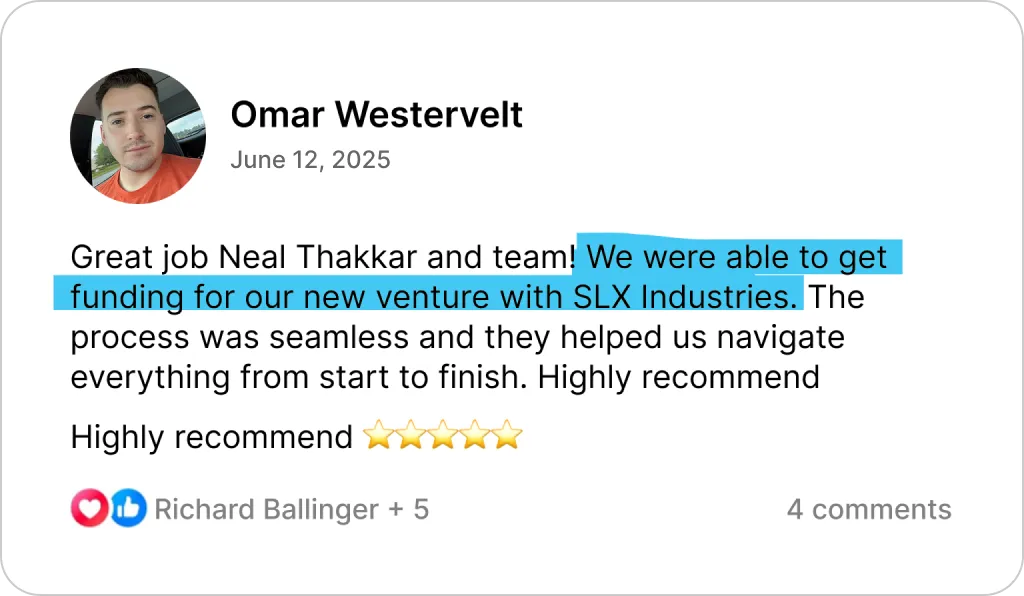

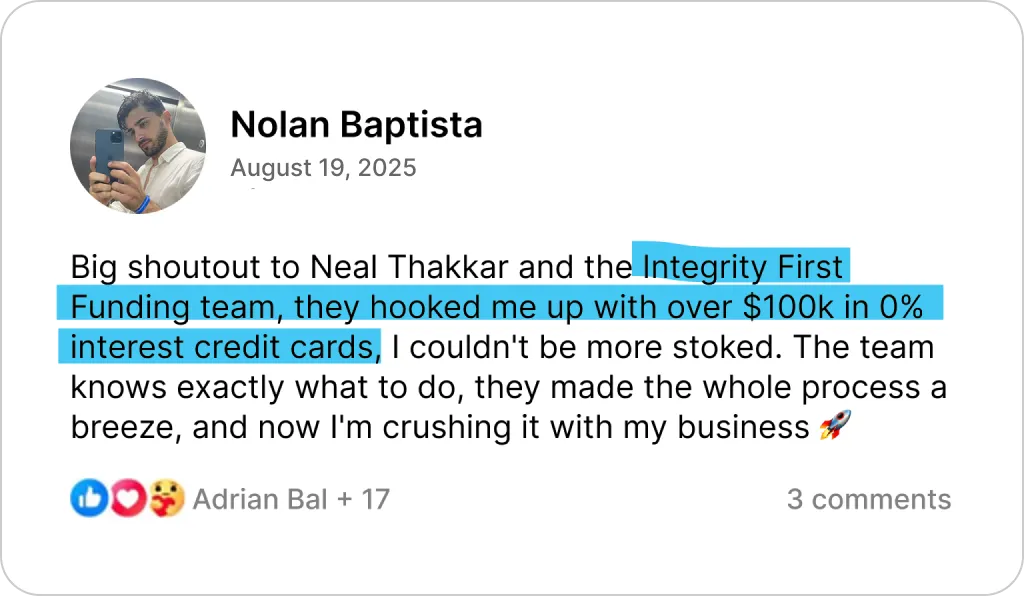

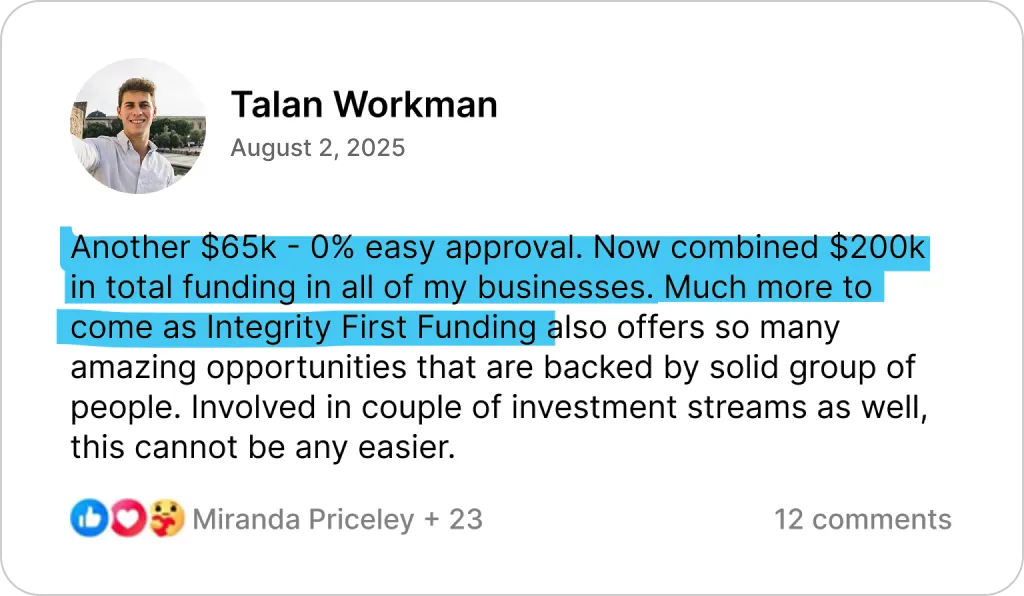

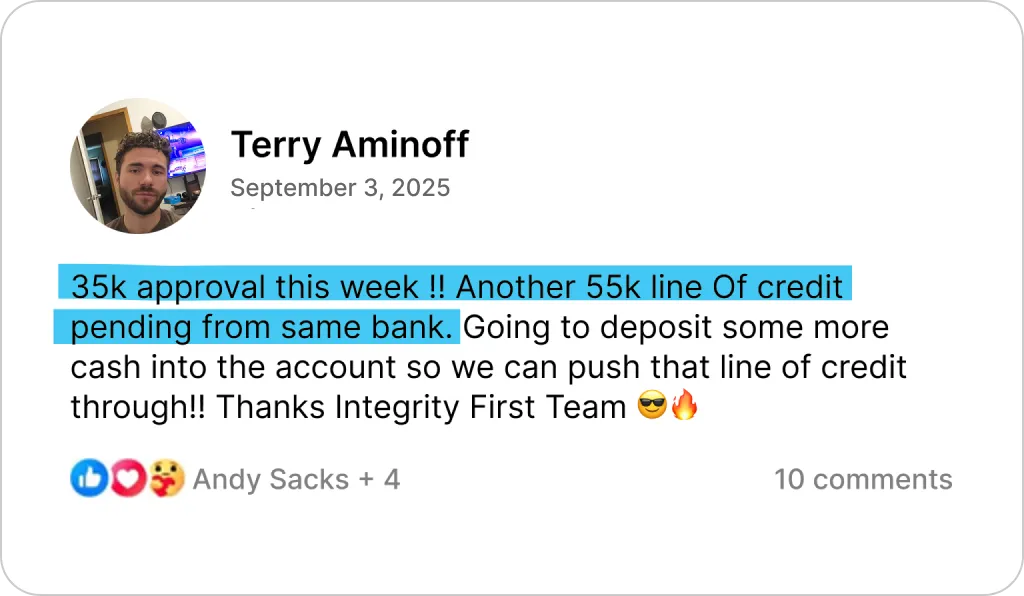

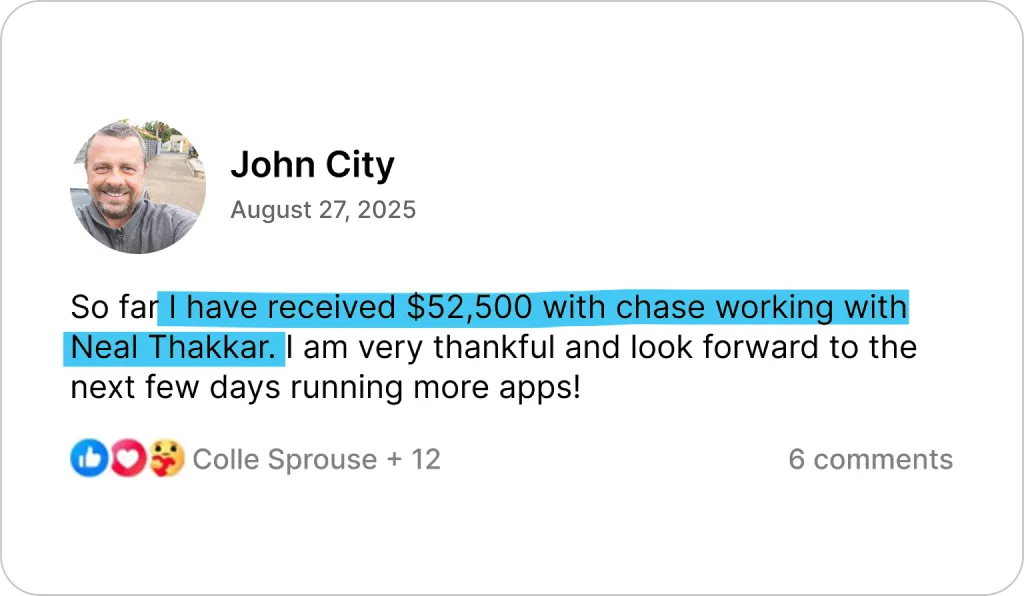

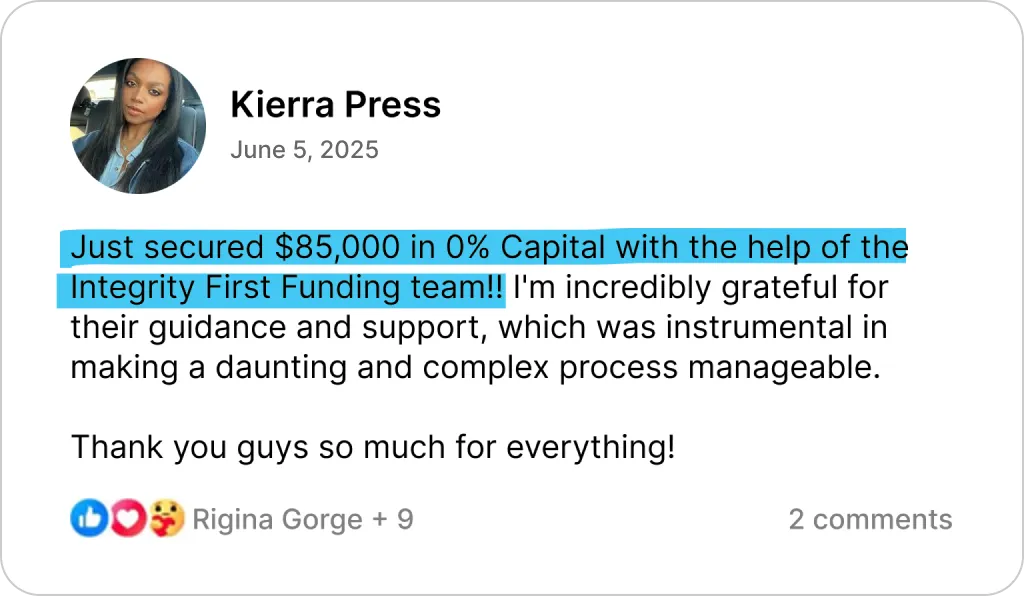

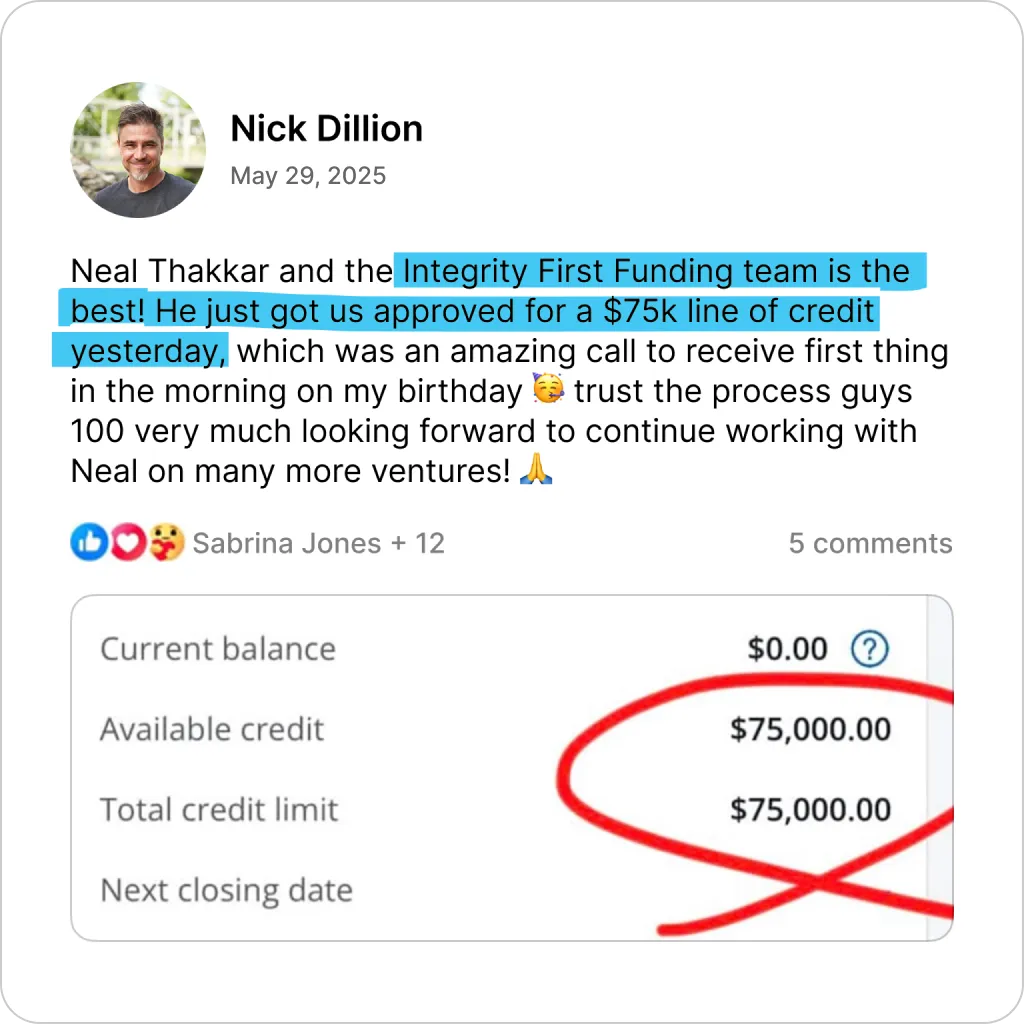

From restaurants and retailers to startups and service pros, our clients come from every industry—but they all have one thing in common: they needed funding fast, and we delivered.

Here’s how Integrity First Funding helped real business owners overcome obstacles, unlock growth, and keep pushing forward. Don’t just take our word for it—read their stories, see the results, and hear what they have to say.

Real People.

Real Businesses.

Real Results.

From restaurants and retailers to startups and service pros, our clients come from every industry—but they all have one thing in common: they needed funding fast, and we delivered.

Here’s how Integrity First Funding helped real business owners overcome obstacles, unlock growth, and keep pushing forward. Don’t just take our word for it—read their stories, see the results, and hear what they have to say.

What Our Clients Say

Our Mission

To empower business owners with fast, honest, and accessible funding—while delivering an experience built on trust, not transactions.

Our Vision

To be the most respected name in alternative business funding—known not just for what we provide, but for how we serve.

Ready to Get Funded?

It starts with a quick call. No hard credit pull. No commitment.

Just clarity, strategy, and access to the capital you deserve.

What Our Clients Say

Our Mission

To empower business owners with fast, honest, and accessible funding—while delivering an experience built on trust, not transactions.

Our Vision

To be the most respected name in alternative business funding—known not just for what we provide, but for how we serve.

Ready to Get Funded?

It starts with a quick call. No hard credit pull. No commitment.

Just clarity, strategy, and access to the capital you deserve.

Still Have Questions?

We get it. Funding can feel overwhelming. That’s why we’re here to walk you through every step — with transparency and zero pressure.

Let’s build your future — the smart way.

How much funding can I really get?

Most of our clients receive between $50,000 and $250,000 in 0% APR funding. The exact amount depends on your current credit profile, business structure, and liquidity. During your free consultation, we’ll show you what you’re likely to qualify for and build a tailored strategy to get you there.

What’s the catch with 0% APR? Is it real?

Yes — it’s 100% real. We specialize in helping business owners access 0% interest introductory periods through strategic applications for credit lines, credit cards, and other capital instruments. These are real financial products from top-tier banks. You just need the right profile to qualify — and that’s what we build for you.

Will this hurt my credit score?

Short term, you may see a minor dip due to inquiries. But we immediately clean up your report after funding as part of our Integrity Protocol — removing inquiries and optimizing your profile so your score recovers and often improves. Long term, our clients typically come out with stronger credit than when they started.

Do I need a business to qualify?

Yes, but even if you're just getting started, we can help you structure your business properly. From forming an entity to building your business credit profile and establishing bank relationships, we handle the groundwork that makes you fundable fast.

Do I need good credit?

Yes & No. To sign up and work with us: you absolutely don’t need to have good credit. If necessary (which is for about 75% of our clients), we can clean up and optimize your credit profile. If you have great personal credit (typically 700+), that’s great — the funding process can start sooner, but even if your score is lower, we will still be able to help.

What industries do you work with?

We work with entrepreneurs across all industries — including e-commerce, coaching, real estate, service businesses, contractors, medical, and more. If you run a small business and want growth capital, you’re in the right place.

How long does the whole process take?

You can get funding in as little as 1–3 weeks, depending on your current credit and business setup. Some clients are ready within 7 days. However, this is only the case if you don’t need credit repair and optimization. Our goal is to get you the most funding possible, so if we do need to repair your profile, give it about 30-90 days. We move as fast as we possibly can and we keep you in the loop at every step.

Is there a guarantee I’ll get funded?

Yes. If we choose to work with you, we are guaranteeing funding. That’s the purpose of the call; to determine if we really can get you funded, and to walk you through the strategy.

✅ We’ll tell you upfront if we can’t help

✅ We only work with clients we’re confident we can fund

✅ If you’re a good fit, we will do everything in our power to get you the highest amount of capital possible

We don't waste your time or our own. Our reputation is built on integrity — and results.

How much does it cost?

Our pricing requires a small up front retainer (that will vary depending on your specific situation), which covers our up front costs. Then, we also charge a performance-based transparent closing cost, where you pay based on how much we get you, and you pay only AFTER you get funded. We walk you through the exact cost structure during your consultation — and we don’t move forward unless the value is crystal clear.

How do I get started?

Easy. Just click the button below to schedule your free consultation. We’ll review your goals, assess your fundability, and map out a personalized capital strategy. No commitment. No pressure. Just facts, numbers, and a path forward.

Business Name: Integrity First Consulting Inc.

Email: [email protected]

Phone: (732) 580-2044

Address: 293 Cardiff Dr, Morganville, 07751, New Jersey

Still Have Questions?

We get it. Funding can feel overwhelming. That’s why we’re here to walk you through every step — with transparency and zero pressure.

Let’s build your future — the smart way.

How much funding can I really get?

Most of our clients receive between $50,000 and $250,000 in 0% APR funding. The exact amount depends on your current credit profile, business structure, and liquidity. During your free consultation, we’ll show you what you’re likely to qualify for and build a tailored strategy to get you there.

What’s the catch with 0% APR? Is it real?

Yes — it’s 100% real. We specialize in helping business owners access 0% interest introductory periods through strategic applications for credit lines, credit cards, and other capital instruments. These are real financial products from top-tier banks. You just need the right profile to qualify — and that’s what we build for you.

Will this hurt my credit score?

Short term, you may see a minor dip due to inquiries. But we immediately clean up your report after funding as part of our Integrity Protocol — removing inquiries and optimizing your profile so your score recovers and often improves. Long term, our clients typically come out with stronger credit than when they started.

Do I need a business to qualify?

Yes, but even if you're just getting started, we can help you structure your business properly. From forming an entity to building your business credit profile and establishing bank relationships, we handle the groundwork that makes you fundable fast.

Do I need good credit?

Yes & No. To sign up and work with us: you absolutely don’t need to have good credit. If necessary (which is for about 75% of our clients), we can clean up and optimize your credit profile. If you have great personal credit (typically 700+), that’s great — the funding process can start sooner, but even if your score is lower, we will still be able to help.

What industries do you work with?

We work with entrepreneurs across all industries — including e-commerce, coaching, real estate, service businesses, contractors, medical, and more. If you run a small business and want growth capital, you’re in the right place.

How long does the whole process take?

You can get funding in as little as 1–3 weeks, depending on your current credit and business setup. Some clients are ready within 7 days. However, this is only the case if you don’t need credit repair and optimization. Our goal is to get you the most funding possible, so if we do need to repair your profile, give it about 30-90 days. We move as fast as we possibly can and we keep you in the loop at every step.

Is there a guarantee I’ll get funded?

Yes. If we choose to work with you, we are guaranteeing funding. That’s the purpose of the call; to determine if we really can get you funded, and to walk you through the strategy.

✅ We’ll tell you upfront if we can’t help

✅ We only work with clients we’re confident we can fund

✅ If you’re a good fit, we will do everything in our power to get you the highest amount of capital possible

We don't waste your time or our own. Our reputation is built on integrity — and results.

How much does it cost?

Our pricing requires a small up front retainer (that will vary depending on your specific situation), which covers our up front costs. Then, we also charge a performance-based transparent closing cost, where you pay based on how much we get you, and you pay only AFTER you get funded. We walk you through the exact cost structure during your consultation — and we don’t move forward unless the value is crystal clear.

How do I get started?

Easy. Just click the button below to schedule your free consultation. We’ll review your goals, assess your fundability, and map out a personalized capital strategy. No commitment. No pressure. Just facts, numbers, and a path forward.

Business Name: Integrity First Consulting Inc.

Email: [email protected]

Phone: (732) 580-2044

Address: 293 Cardiff Dr, Morganville, 07751, New Jersey