Debt Elimination Program

A Clear, Structured Path

Out of Unsecured Debt

High-interest debt shouldn’t hold back entrepreneurs.

Our Debt Elimination Program helps clients remove or reduce unsecured debt through a strategic,

legally aligned process — without bankruptcy and without endless minimum payments.

For individuals with $10,000+ in unsecured debt.

Who This Is For

Ideal for individuals who are…

Carrying $10K+ in unsecured debt

Struggling with credit card interest or collections

Seeking a structured, attorney-backed path to eliminate debt

Wanting one simple monthly payment, not multiple bills

Ready to rebuild credit after debt relief

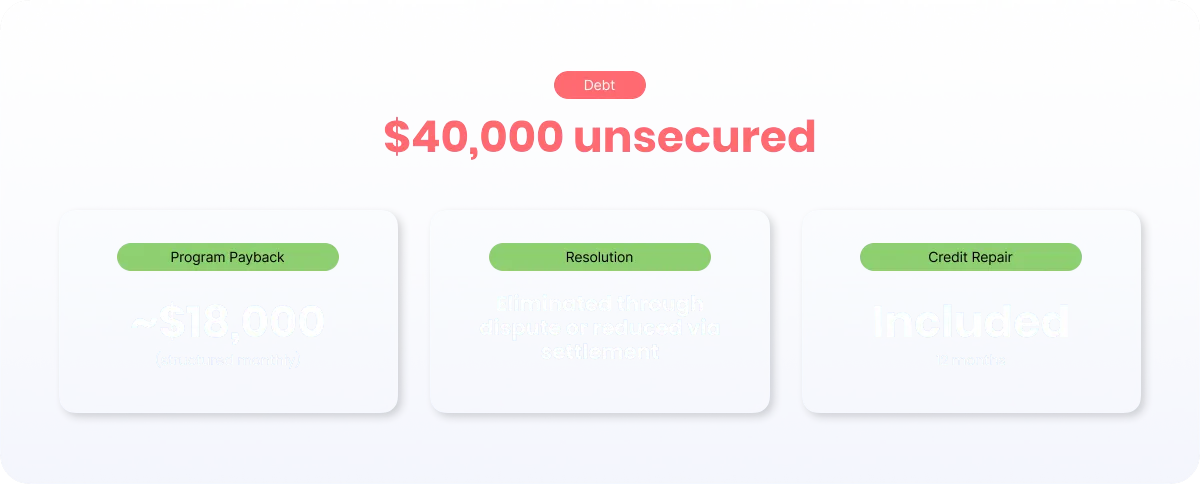

What You Pay

Most clients pay back only ~30–50% of their total unsecured debt.

No compounding interest

One predictable monthly payment

Structured over 36–48 months

Significant financial relief while protecting long-term

How the Program Works

A Simple Two-Phase System

Client Example

Program Summary

Key Features

Why Integrity First Recommends This Program

Debt robs entrepreneurs of momentum, clarity, and breathing room.

We’ve partnered with Total Credit Relief because their system gives people a real path back to stability, without forcing them into bankruptcy or predatory alternatives.

This program exists so you can rebuild — stronger, smarter, and with a clean foundation for future funding

Want to know if you qualify?

Speak with an Integrity First advisor for a simple, pressure-free consultation.

You’ll get clarity on:

Contact Us

Email Address: [email protected]

Phone: (732) 580 - 2044

Address: 293 Cardiff Dr, Morganville, 07751, New Jersey

© 2025 Integrity First Funding. All rights reserved.

Debt Elimination Program

A Clear, Structured Path

Out of Unsecured Debt

High-interest debt shouldn’t hold back entrepreneurs.

Our Debt Elimination Program helps clients remove or reduce unsecured debt through a strategic,

legally aligned process — without bankruptcy and without endless minimum payments.

For individuals with $10,000+ in unsecured debt.

Who This Is For

Ideal for individuals who are…

Carrying $10K+ in unsecured debt

Struggling with credit card interest or collections

Seeking a structured, attorney-backed path to eliminate debt

Wanting one simple monthly payment, not multiple bills

Ready to rebuild credit after debt relief

What You Pay

Most clients pay back only ~30–50% of their total unsecured debt.

No compounding interest

One predictable monthly payment

Structured over 36–48 months

Significant financial relief while protecting long-term

How the Program Works

A Simple Two-Phase System

Client Example

Program Summary

Key Features

For clients with $10,000+ unsecured debt

Works for credit cards, medical bills, collections, and more

Average payback: 30–50% of total debt

Two-phase approach (Dispute → Settlement if needed)

Program length: 2–3 years including credit repair

Free, comprehensive credit restoration at the end

Why Integrity First Recommends This Program

Debt robs entrepreneurs of momentum, clarity, and breathing room.

We’ve partnered with Total Credit Relief because their system gives people a real path back to stability, without forcing them into bankruptcy or predatory alternatives.

This program exists so you can rebuild — stronger, smarter, and with a clean foundation for future funding

Want to know if you qualify?

Speak with an Integrity First advisor for a simple, pressure-free consultation.

You’ll get clarity on: